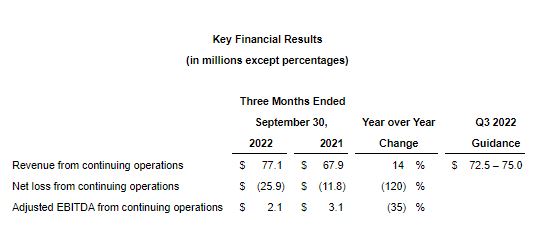

- Revenue from continuing operations of $77.1 million increased 14% vs. a year ago

- GAAP net loss from continuing operations of $25.9 million vs. $11.8 million a year ago

- Adjusted EBITDA from continuing operations of $2.1 million vs. $3.1 million a year ago

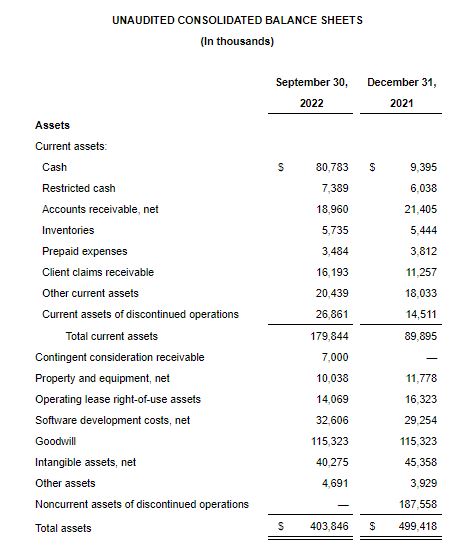

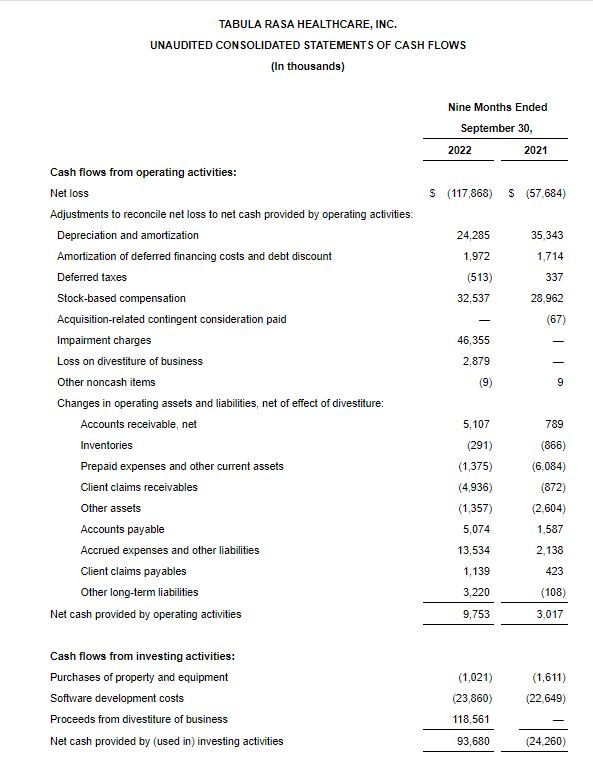

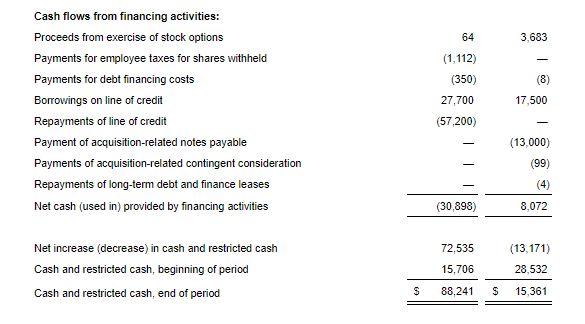

- Cash of $80.8 million as of September 30, 2022, vs. $26.5 million as of June 30, 2022

MOORESTOWN, N.J., Nov 3, 2022 – Tabula Rasa HealthCare, Inc.® (Nasdaq:TRHC), a leading healthcare technology company advancing the safe use of medications, today reported financial results for the second quarter ended September 30, 2022.

“We delivered another quarter of solid revenue growth and continue on a pace to perform strongly against our 2022 guidance. With our strong position in PACE today, serving more than eight out of every ten participants, we have a robust foundation to build upon as we enter adjacent value-based care markets that are exponentially larger and focus on high-cost, high-risk patients. We are committed to driving shareholder value by narrowing our focus to core assets and markets with a competitive advantage to improve top-line growth and enhance margins,” said Brian Adams, President and Interim CEO.

Third Quarter 2022 Financial Results

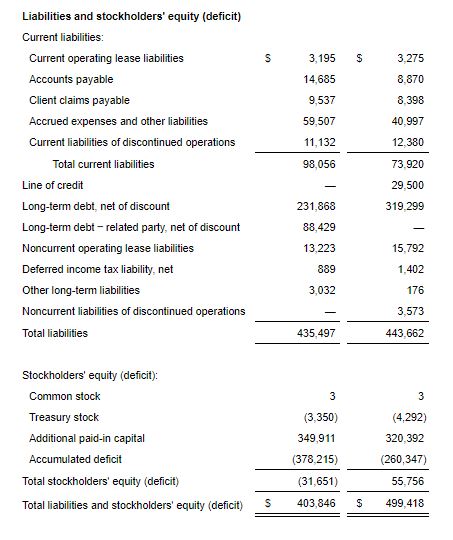

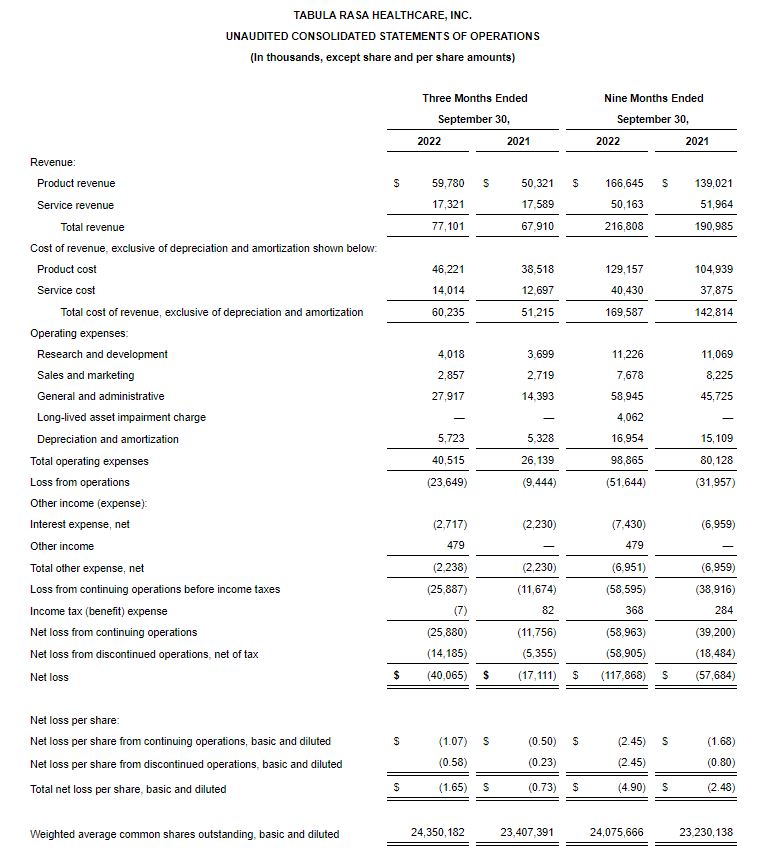

All comparisons, unless otherwise noted, are to the three months ended September 30, 2021, and reflect continuing operations

- Revenue – Revenue of $77.1 million increased 14% compared to $67.9 million in 2021. Product (medication) revenue of $59.8 million increased 19% due to strong PACE participant growth. Service revenue of $17.3 million decreased 2% from the year ago period. Excluding $2.3 million of revenue related to the concluded CMS Enhanced Medication Therapy Management (“EMTM”) pilot program included in the third quarter of 2021, service revenue increased 13%, led by growth in our pharmacy benefit management (“PBM”) and risk adjustment services, each of which grew by more than 20%.

- GAAP net loss – GAAP net loss from continuing operations of $25.9 million compared to a loss of $11.8 million a year ago with the decline largely driven by costs, including stock-based compensation of $8.1 million and other expenses, related to the leadership transition and cooperation agreement with Indaba Capital Management announced on September 14, 2022. Gross margin, excluding depreciation and amortization, of $16.9 million (21.9% of revenue) increased as compared to $16.7 million (24.6% of revenue) a year ago. The decline in gross margin as a percentage of revenue was largely driven by product and service revenue mix, as well as increased shipping charges.

- GAAP net loss from discontinued operations of $14.2 million compares to a loss of $5.4 million a year ago and includes the SinfoníaRx and DoseMe businesses, as well as one month of the PrescribeWellness business. As previously announced, TRHC’s sale of PrescribeWellness closed on August 1, 2022.

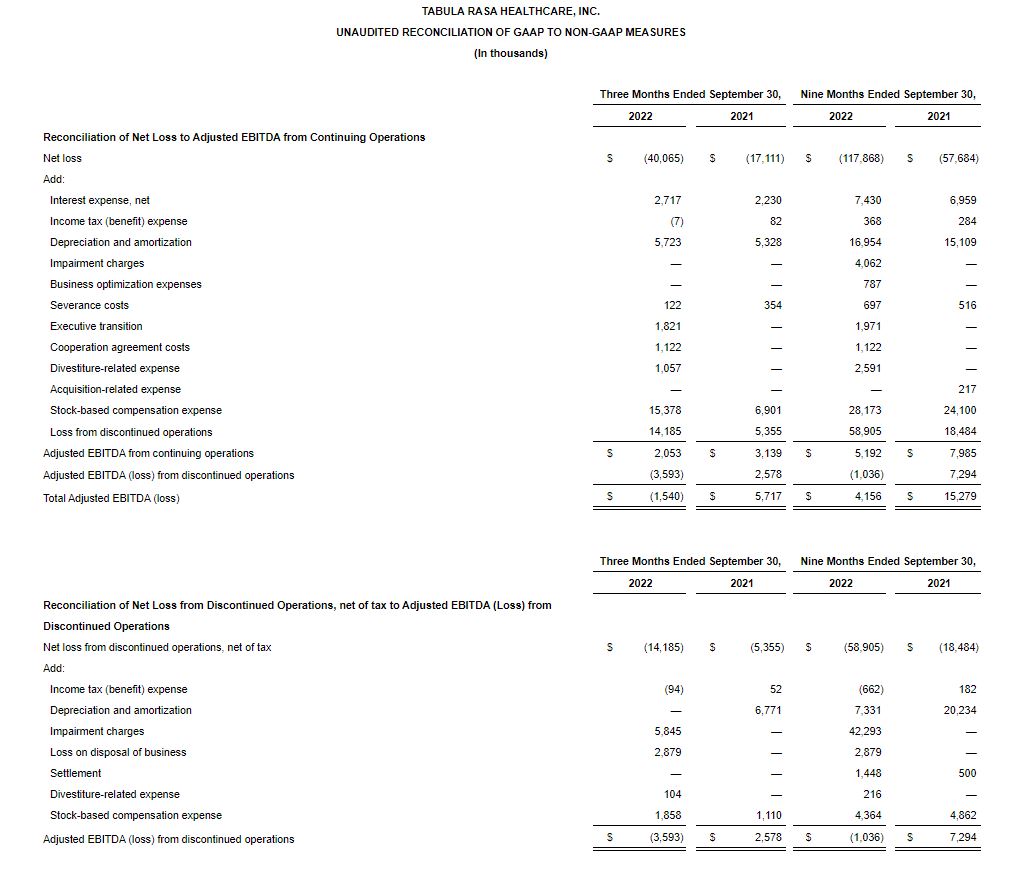

- Adjusted EBITDA – Adjusted EBITDA from continuing operations of $2.1 million (2.7% margin) declined as compared to $3.1 million (4.6% margin) a year ago, primarily due to the timing of cash compensation expense, as well as the reasons noted above negatively impacting gross margin.

A reconciliation of generally accepted accounting principles (“GAAP”) in the United States to non-GAAP results has been provided in this press release in the accompanying tables. An explanation of these measures is also included below under the heading “Non-GAAP Financial Measures.”

Operational Metrics

To provide greater transparency into our financial results, we are providing the following operational metrics.

- Total PACE participants utilizing at least one of our solutions increased by 8% as of September 30, 2022, to 52,230, as compared to September 30, 2021.

- Average PACE per member per month revenue increased 9% during the third quarter of 2022, as compared to the same period a year ago. This metric is defined as quarterly revenue for PACE clients across all service lines divided by quarterly member months.

- PACE participants for our pharmacy services as of September 30, 2022, increased 18% as compared to a year ago. This growth was driven by continued participant growth at existing PACE centers and the onboarding of a large PACE program in California completed during the third quarter.

- PACE backlog as of September 30, 2022, stands at 56 implementations (by product and service), valued at $54 million in annual revenue at maturity, which the Company defines as enrollment of 250 participants. By comparison, these figures were 65 implementations and $59 million as of June 30, 2022.

- PACE implementations during the third quarter and first nine months of 2022 totaled 16 and 38, respectively, as compared with 4 and 19, respectively, in the same period a year ago.

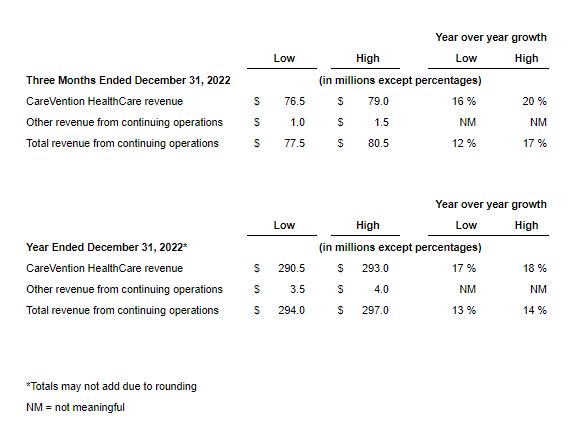

Business Outlook

This outlook updates the previously issued financial guidance that was provided on August 4, 2022.

Upcoming Events

Members of TRHC’s executive team will be presenting at the following conferences:

- Piper Sandler’s 34th Annual Healthcare Conference from November 29th to December 1st, and

- The Benchmark Company 11th Annual Discovery One-on-One Conference on December 1st.

Quarterly Conference Call

The third quarter 2022 earnings conference call and webcast will be held tomorrow, Friday, November 4, 2022, at 8:30 a.m. ET. Those interested in participating via webcast in listen-only mode can access the event here. For participants who would like to participate via telephone, please register here to receive the dial-in number along with a unique PIN number that is required to access the call. A replay of the earnings call will be available via webcast at the Investor Relations section of TRHC’s website (ir.tabularasahealthcare.com).

About Tabula Rasa HealthCare

Tabula Rasa HealthCare provides medication safety solutions that empower healthcare professionals and consumers to optimize medication regimens, combatting medication overload and reducing adverse drug events – the fourth leading cause of death in the U.S. TRHC’s proprietary technology solutions, including MedWise®, improve patient outcomes, reduce hospitalizations, and lower healthcare costs. TRHC’s extensive clinical tele-pharmacy network improves care for patients nationwide. Its solutions are trusted by health plans and pharmacies to help drive value-based care. For more information, visit TRHC.com.

Non-GAAP Financial Measures

In addition to reporting all financial information required in accordance with GAAP, TRHC is also reporting Adjusted EBITDA, which is considered a non-GAAP financial measure. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance or financial position that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. Adjusted EBITDA consists of net loss plus certain other expenses, which includes interest expense, provision for income tax, depreciation and amortization, impairment charges, settlement costs, business optimization expenses, severance costs, executive transition costs, divestiture-related expense, acquisition-related expense, and stock-based compensation expense. TRHC considers settlement costs to include amounts payable by TRHC or reductions to amounts owed to TRHC as a result of a contractual settlement. TRHC considers business optimization expenses to include contract termination payments, severance, retention payments, and other employee and non-recurring vendor costs incurred related to our business optimization initiatives during 2022. TRHC considers executive transition costs to include nonrecurring costs related to hiring and onboarding of newly named executive officers. TRHC considers severance costs to include severance payments related to the realignment of our resources. TRHC considers divestiture-related expense to include nonrecurring direct transaction costs. TRHC considers acquisition-related expense to include nonrecurring direct transaction and integration costs. TRHC believes the exclusion of these items assists in providing a more complete understanding of the company’s underlying operations results and trends and allows for comparability with TRHC’s peer company index and industry and to be more consistent with TRHC’s expected capital structure on a going forward basis.

TRHC presents this non-GAAP financial measure in this release because it considers it to be an important supplemental measure of performance. TRHC uses this non-GAAP financial measure for planning purposes, including analysis of the company’s performance against prior periods, the preparation of operating budgets and determination of appropriate levels of operating and capital investments. TRHC believes that this non-GAAP financial measure provides additional insight for analysts and investors in evaluating the company’s financial and operational performance. TRHC also intends to provide this non-GAAP financial measure as part of the Company’s future earnings discussions and, therefore, its inclusion should provide consistency in the Company’s financial reporting.

Non-GAAP financial measures have limitations as an analytical tool. Investors are encouraged to review the reconciliation of Adjusted EBITDA to its most directly comparable GAAP measures provided in this release, including in the accompanying tables.

Safe Harbor Statement This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that we believe to be reasonable as of today’s date. Forward-looking statements give current expectations or forecasts of future events or our future financial or operating performance, and include TRHC’s expectations regarding healthcare regulations, industry trends, available opportunities to TRHC, the financial and operating performance of TRHC, the impacts of the COVID-19 pandemic, the plans and objectives of management, TRHC’s strategic initiatives and the anticipated benefits thereof, and TRHC’s expectations for 2022. Such statements are identified by use of the words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “should,” “goals” and similar expressions. These forward-looking statements are based on management’s good-faith expectations, judgements and assumptions as of the date of this press release. Actual results might differ materially from those explicit or implicit in the forward-looking statements. Important factors that could cause actual results to differ materially include: the impacts of the ongoing COVID-19 pandemic; our continuing losses and need to achieve profitability; fluctuations in our financial and operating results; our ability to manage our cash flows; the volatility of our stock price; the extent to which we are successful in gaining new long-term relationships with clients or retaining existing clients; the acceptance and use of our products and services by PACE organizations; the need to innovate and provide useful products and services; risks related to changing healthcare and other applicable governmental regulations; our ability to maintain relationships with a specified drug wholesaler; increasing consolidation in the healthcare industry; competition from a variety of companies in the healthcare industry; managing our growth effectively; our ability to adequately protect our intellectual property; macroeconomic conditions, including the impact of inflation, on our business and operations; the sale of the PrescribeWellness business; our ability to execute on our planned divestitures of our SinfoníaRx and DoseMe businesses; risks related to actions of activist stockholders; and the other risk factors set forth from time to time in our filings with the Securities and Exchange Commission (“SEC”), including those factors discussed under the caption “Risk Factors” in our most recent annual report on Form 10-K, filed with the SEC on February 25, 2022, and in subsequent reports filed with or furnished to the SEC, copies of which are available free of charge within the Investor Relations section of the Tabula Rasa HealthCare website http://ir.trhc.com or upon request from our Investor Relations Department. Tabula Rasa HealthCare assumes no obligation and does not intend to update these forward-looking statements, except as required by law, to reflect events or circumstances occurring after today’s date.